Binary Stream makes Inspire, the premier Microsoft partner event, a critical date in the annual calendar as it allows us to take the time to align our solutions and partner enablement programs with Microsoft’s overall direction. This year was no different, and we were excited to celebrate our shared vision of driving innovation and transformation in the Business Applications ecosystem. The event showcased a multitude of groundbreaking announcements that will reshape the future of technology.

Lak Chahal, CEO of Binary Stream, expressed his delight at the opportunity to attend from Microsoft Canada HQ in Toronto, stating, “It is a wonderful opportunity to align with Microsoft as we continue to grow our offerings in the channel. We are excited about the prospects of growing our partnerships and the transformative potential of the announcements made this year.”

The event witnessed a host of significant highlights, underscoring Microsoft’s commitment to driving technological advancements; below is a quick summary of the highlights:

In pursuit of bolstering Commercial Marketplace and Independent Software Vendor (ISV) Success, Microsoft has made significant strategic investments. These endeavours include co-selling initiatives aligned with the marketplace and introducing the concept of multiparty private offers to facilitate smooth transactions. Moreover, ISV Success is now readily accessible, empowering Software as a Service (SaaS) providers to develop applications that leverage the full potential of the Microsoft Cloud, with seamless integration and the opportunity to market and distribute their solutions through the dynamic marketplace. These advancements aim to foster innovation and growth, benefiting both Microsoft and its valued partners in the ever-evolving technology landscape.

Microsoft’s Power Platform continues to revolutionize process optimization with the introduction of Power Automate Process Mining, a cutting-edge tool that harnesses the power of artificial intelligence to provide unparalleled insights into organizational processes. By delving deep into workflows and operations, this advanced solution offers valuable data-driven suggestions to streamline and enhance efficiency.

In addition to this groundbreaking innovation, Microsoft has taken strides to optimize its licensing for Power Platform, ensuring a seamless alignment with customer needs and preferences. With a renewed focus on portfolio enhancement and customer-centricity, the updated licensing model promises to unlock even greater value for businesses, empowering them to achieve their goals with unmatched ease and precision.

The landscape of business is undergoing a remarkable transformation, and at the forefront of this evolution are three powerful tools that promise to reshape the way companies interact with their customers and optimize their operations. First and foremost, Sales Copilot takes center stage by equipping sellers with invaluable resources for forging personalized and meaningful customer interactions. Harnessing the potential of data-driven insights, Sales Copilot empowers sales teams to engage with clients in a tailored and impactful manner, fostering long-term relationships and driving revenue growth.

Next, Dynamics 365 Customer Insights emerges as a game-changer, providing organizations with a comprehensive customer data platform that enables a deep understanding of their clientele. With sophisticated journey orchestration capabilities, businesses can now deliver seamless experiences across touchpoints, further solidifying customer loyalty. Completing this transformative trio is AIM, an indispensable facilitator that eases the transition from on-premises to cloud-first Dynamics 365 applications. By embracing cloud technology, organizations can unlock enhanced scalability, security, and efficiency, propelling them into a future of unparalleled success and innovation.

The integration of AI in Microsoft 365 and Bing Chat Enterprise marks a significant leap forward in workplace efficiency and data protection. With Bing Chat Enterprise’s AI-powered chat functionality, businesses can now communicate and collaborate seamlessly, while robust data protection measures ensure sensitive information remains secure. Microsoft 365 takes productivity to new heights with the introduction of Copilot Pricing, leveraging generative AI to streamline workflows and empower users with intelligent suggestions and automation.

Moreover, the latest AI capabilities within Microsoft 365 encompass a wide range of offerings, from Teams Phone and Chat functionalities, Viva updates, to the innovative Windows 365 Frontline, Backup, and Archive features. These advancements not only enhance user experiences but also elevate organizational performance, setting a new standard for AI-driven productivity tools in the modern workplace.

In today’s rapidly evolving business landscape, companies are increasingly relying on recurring revenue models to drive sustainable growth. Among the key metrics used to measure success in the subscription economy, Annual Recurring Revenue (ARR) stands out as a powerful indicator of a company’s financial health and future prospects. ARR serves as a litmus test for businesses, offering valuable insights into revenue stability, customer retention, and growth potential. By providing a comprehensive understanding of a company’s expected revenue streams, ARR enables more accurate forecasting, strategic decision-making, and long-term planning.

In this blog, we will delve into the frequently asked questions surrounding ARR, specifically in the XaaS and subscription economies, shedding light on its significance and best practices for tracking and reporting this critical metric.

As companies continue to expand their recurring revenue streams, it becomes imperative to establish effective reporting systems and keep a close eye on crucial metrics like ARR. To help you navigate the complexities of this vital metric, we will address some frequently asked questions in the context of the SaaS and subscription economies. If you have a specific question and would like to jump to that answer, simply click the question that interest you below.

Annual Recurring Revenue (ARR) is a key financial metric used in the subscription economy to measure the predictable and recurring revenue that a company expects to receive from its subscriptions or contracts over a period of one year. ARR specifically focuses on the value of term subscriptions normalized for a single calendar year.

What sets ARR apart from other revenue metrics is its emphasis on recurring revenue. Unlike one-time or sporadic sales, ARR accounts for the ongoing revenue generated from subscriptions that renew or continue on an annual basis. It provides a clearer and more reliable picture of a company’s revenue stability and growth potential by excluding one-time or non-recurring revenue sources.

Traditional revenue metrics, such as total revenue or monthly revenue, may not accurately reflect the long-term revenue outlook for subscription-based businesses. These metrics can be influenced by sporadic or seasonal sales, making it challenging to assess the sustainability and predictability of a company’s revenue stream.

In contrast, ARR focuses on the annualized value of recurring revenue, providing a more consistent and predictable measure of a company’s revenue performance. It enables businesses to evaluate their growth trajectory, assess customer retention rates, and forecast future revenue with greater accuracy. By concentrating on recurring revenue, ARR aligns closely with the core revenue model of subscription-based businesses, making it a valuable metric for understanding and analyzing their financial health.

ARR is regarded as a reliable indicator of a company’s health and growth potential for several reasons:

ARR plays a critical role in enhancing forecasting accuracy and facilitating strategic decision-making for businesses. Here’s how ARR impacts these aspects:

When calculating Annual Recurring Revenue (ARR), companies should consider the following factors to ensure accuracy and completeness:

![]()

Tracking and reporting ARR effectively involves implementing best practices to ensure accuracy, consistency, and transparency. Here are some key practices to consider:

Subscription Billing Suite (SBS) is a comprehensive software solution designed to automate the tracking and calculation of Annual Recurring Revenue (ARR) for companies operating in the subscription economy. By leveraging SBS, businesses can streamline their revenue management processes, reduce manual errors, and maximize their revenue streams. The suite offers robust features for managing subscription lifecycles, including automated billing, invoicing, and revenue recognition.

It seamlessly integrates with Microsoft Dynamics 365 solutions, ensuring accurate and up-to-date data synchronization. With Subscription Billing Suite, companies can gain real-time insights into their ARR, monitor subscription performance, and identify opportunities for upselling, cross-selling, and retention. By automating ARR calculations and revenue management, companies can focus on strategic initiatives, optimize their revenue potential, and drive sustainable growth in the subscription economy.

Are you struggling with invoicing processes that lack visibility and control across multiple locations? Do you want to streamline your accounts payable (AP) processes and automate invoicing to reduce errors and increase efficiency? If so, you need to check out the American Software case study.

The Atlanta-based company faced several challenges due to its holding company structure and lack of automation, which were compounded by the COVID-19 pandemic. However, by implementing a custom combination of KwikTag and Multi-Entity Management (MEM), American Software saved $50,000 in the first year, automated and streamlined its AP processes, and established itself as a source of truth for its accounting department.

The MEM solution allowed them to manage multiple entities across states and countries, reduce errors and time required for reconciliations, track bills and invoices more efficiently, and streamline intercompany payments. The solution was fully integrated within just 30 days, and the team could work safely from home during the pandemic, boosting morale and productivity.

You can download the case study to learn more about how American Software improved its invoicing processes, reduced errors, and increased efficiency. You will discover how the company improved internal control and credibility, simplified audits, consolidated emails related to approvals, and saved valuable time and resources.

Don’t miss the opportunity to learn how American Software overcame challenges and improved its invoicing processes with KwikTag and MEM. Download the case study today and see how you can achieve similar results for your organization!

Payment gateways are an essential tool for processing e-commerce transactions securely. That’s why you need to understand how they work and what sets the best ones apart from the glut of options on the market. As businesses undergo exponential growth, many finance teams require help to manage the sheer volume of invoices. Without a solution to augment their productivity, bottlenecks form and errors creep in, damaging overall efficiency and leading to customer churn.

Empowering your customers to take ownership of their payment details allows them to play an active role in transactions. This takes some of the heat off accountants and enables them to focus on more strategic roles while building customer trust. Payment gateways also provide an extra layer of data protection, establishing a secure environment to process payments without compromising customer experience.

If you’re interested in a specific question about payment gateways, skip ahead by clicking on the topic below.

A payment gateway is an online payment solution that verifies credit card details and transfers funds for e-commerce transactions. It acts as an intermediary between the customer and the merchant, creating a secure environment to send and receive payment details between the merchant’s website, the customer’s financial institution, and the merchant’s financial institution.

There are three types of payment gateways:

1.) Redirect

2.) On-site

3.) On-site checkout and off-site payment

Redirect, or hosted, payment gateways forward the customer to a different website to complete their purchase. Therefore, the payment gateway does not integrate into the merchant’s website, which can result in fewer conversions.

On-site payment gateways mean the merchant’s server completes the payment process. Large enterprises typically implement these because they offer maximal control over the process and have the resources to manage higher complexity and responsibility.

Finally, some payment gateways offer a hybrid approach where the customer completes checkout on the merchant’s website, but a third-party redirect website processes the payment. This type of gateway is convenient and straightforward, like redirect gateways, but lacks the total control offered by on-site gateways.

A registered merchant account is a type of bank account required of all businesses to accept debit or credit cards and receive payment. Payment service providers typically provide these accounts for merchants.

A payment service provider (PSP) is a third-party company that offers payment services, including payment gateways. These businesses allow companies to accept online payment methods and remain compliant with industry security standards. You’ve probably already heard of some prominent companies, like PayPal or Stripe. SK Global Software offers a premier add-on solution facilitating payments through Microsoft Dynamics 365.

A payment portal refers to the front-end technology that collects customer payment information. Some common types of payment portals include:

A payment gateway will transfer data retrieved from the payment portal during a transaction.

A payment processor transfers a customer’s credit card information between the merchant’s point-of-sale system and the customer’s card network or bank. A payment gateway will request authorization of sensitive information from a payment processor during a transaction.

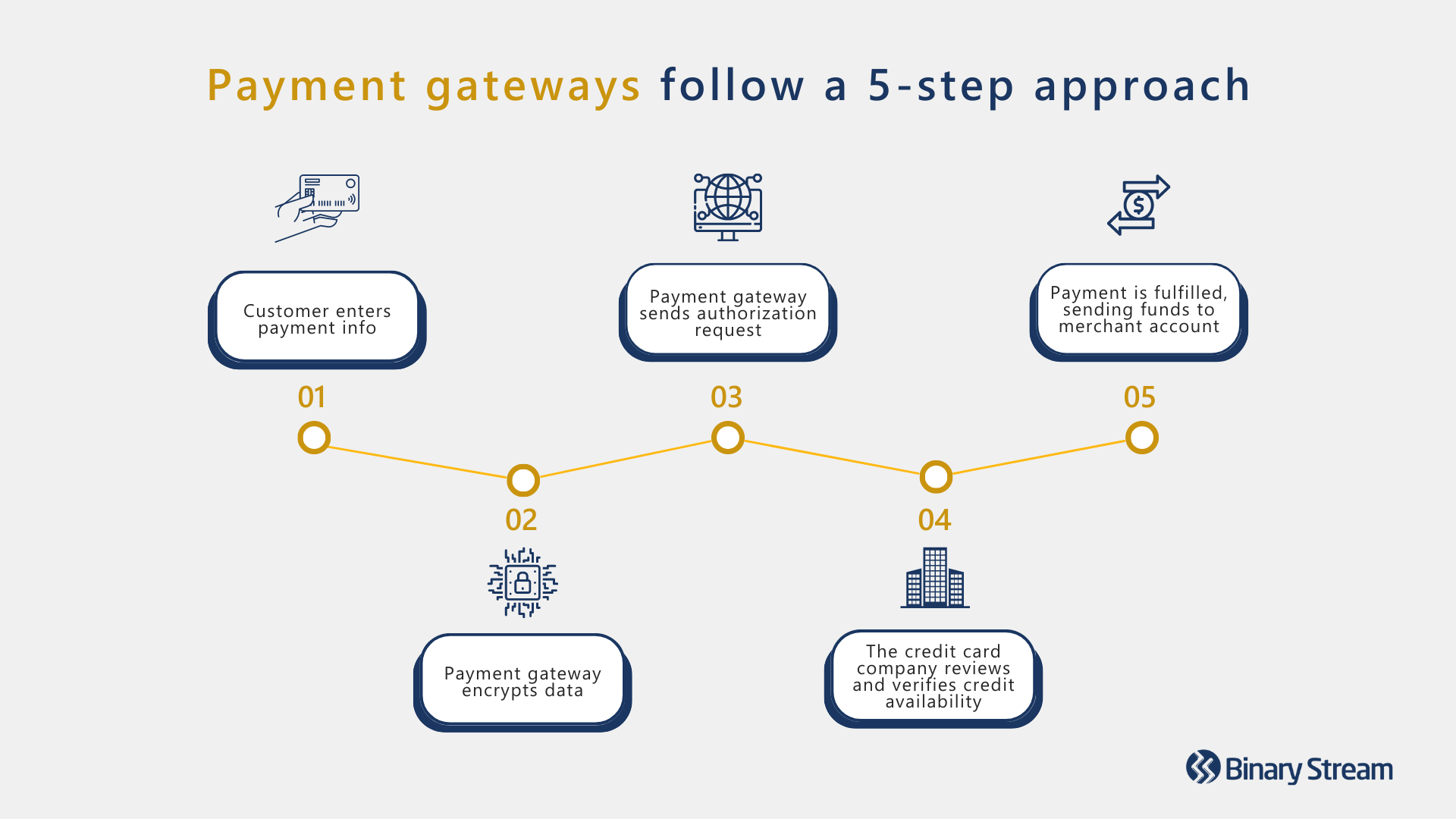

Payment gateways process transactions by following a five-step approach:

1.) The customer enters their payment information on the payment portal.

2.) The payment gateway encrypts their payment details and secures the connection between the portal, gateway, and processor.

3.) The payment gateway sends a transaction authorization request to the payment processor.

4.) The credit card company reviews and verifies credit availability. If sufficient funds exist, the payment processor authorizes the transaction request.

5.) Once the payment gateway receives authorization, the payment can be fulfilled, transferring funds to the merchant account.

Failed online payments are an unfortunate but relatively common occurrence. FlexPay research revealed that nearly half of all subscriber churn is due to failed payments. Therefore, make sure to carefully read the agreement with your provider, as it will include several warranties for the merchant (and sometimes the customer!), as well as a detailed breakdown of the liability of the payment gateway.

Depending on the agreement, PSPs may assume partial to full responsibility for failed transactions, owing the merchant compensation for financial damage. Nevertheless, PSPs are not liable for damages caused by third-party services.

In the event of a failed payment best practice is to directly communicate the error to the customer, then follow up with dunning email automation and payment retry cycles.

The three most common reasons payments fail include system downtime, payment technology errors, and compromised security. However, the transaction can also be unsuccessful because,

Some payment gateways route transactions to multiple payment processors to avoid these issues. With more options available, the system can attempt to resolve errors and downtime before sending the customer a failed payment notification.

Payment gateways are the perfect tool to help manage e-commerce transactions and receive payments online. While finance teams might keep up with a reasonable number of monthly payments, it’s common for workloads to spiral out of control as your customer base expands.

The right payment gateway seamlessly fits into your everyday business operations to support exponential growth while protecting brand reputation and revenue. Modern customers crave convenience and a user-friendly payment process that they can trust. Empowering them to take an active role will build their confidence in online purchases with your company.

If you want more information, check out this blog for an in-depth look at five of the biggest benefits of payment gateways.

Providing a secure shopping experience is a non-negotiable component of successful e-commerce. Breaches could endanger your brand’s reputation and lead to costly fees. PSPs can fine companies $5,000–$100,000 monthly for non-compliance with the PCI DSS.

That’s why it’s vital to maximize the tools and protocols in place that are safeguarding customer information. Below lists five must-have security features for your payment gateway:

The Payment Card Industry Data Security Standard (PCI DSS) is a set of international standards advising businesses on best practices for processing payments securely. The volume of annual transactions your company achieves determines which level of compliance you must meet. The PCI DSS uses a four-level scale to classify businesses:

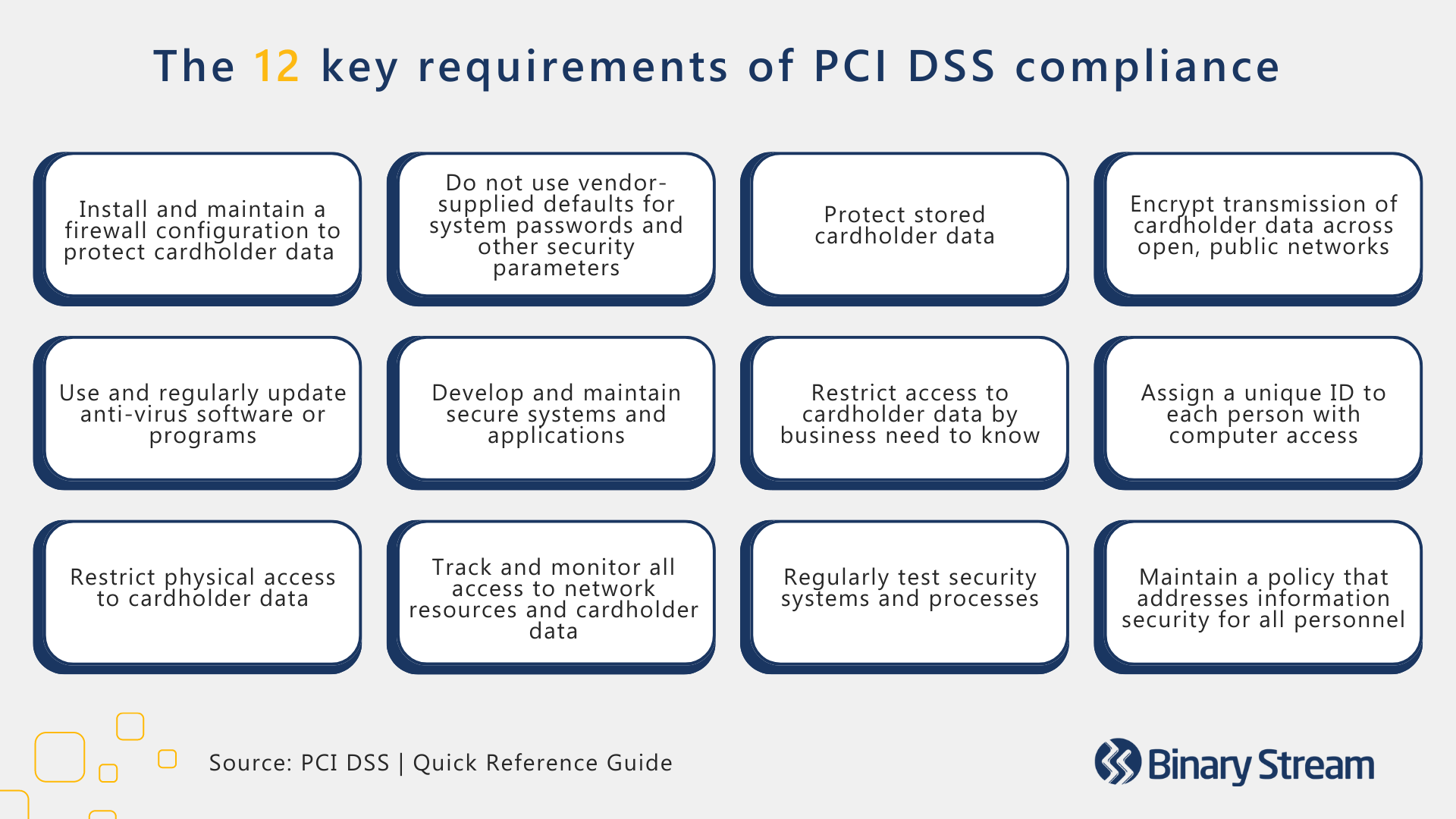

However, any company that accepts credit or debit card purchases must satisfy twelve essential requirements. While all products and services offered by PSPs must comply with the PCI DSS, understanding the basics will help to protect your company against fees and infractions.

There are many factors to consider when determining which payment gateway is the best fit for your business. While payment gateways tend to follow the same five-step approach, they each have limitations. Investing in software that meets all your business requirements is vital.

The following seven questions can help you narrow your search and define the hallmarks of a top-notch payment gateway:

1.) How many types of cards and payment methods does it support?

2.) Can it handle multiple currencies?

3.) Does it offer advanced security protocols, covering encryption and fraud protection?

4.) Is there clear and transparent communication around vendor fees?

5.) Does it integrate with your payment portal and e-commerce software?

6.) Is the front-end convenient and user-friendly?

7.) Will customers have access to 24/7 comprehensive customer support?

It depends. Using multiple payment gateways is more expensive and can muddle an otherwise clean UX, but there are some instances where it’s a beneficial strategy. Implementing more than one gateway expands customer payment options and allows you to assess whether one generates more conversions.

Finding one solution that meets all your business requirements and adequately addresses customer concerns can be tricky, especially for companies growing into international markets. Ultimately, you’ll likely need to experiment to determine the optimal arrangement for your business.

If you’re still feeling lost or are looking for more information, we’re here to help. Feel free to contact our experts with any lingering questions you may have. We can’t wait to meet you!

As 2023 begins, many companies are looking for improvement opportunities and exploring how they can do more with less. Yet, with the constant flux of complexity in doing business, there’s a growing need to transform operations by investing in robust, scalable solutions.

You might wonder how you can invest in technology and save money simultaneously. The answer is simple; it’s the only way to keep pace in today’s markets. The best business applications in 2023 enable agility and cost-savings, in addition to functional improvements. This blog examines six game-changing trends that will set the industry standard this year.

When Gartner coined the term ‘ERP’ in the early 1990s, it was to capture the inclusion of enterprise-focused processes in manufacturing resource planning software. Today, the role of ERP software is to provide a stable core that supports the seamless integration of composable and modular business applications, accelerating the acquisition of emerging capabilities and technologies.

One of the main ways these ‘composable ERPs’ will increase interconnectivity is by leveraging low-code/no-code interfaces. Gartner predicts that, by 2025, 70% of new business application developments will centre on low code, and 50% of all new low-code clients will come from business buyers outside the IT organization.

Since you no longer need to be a programmer to create a custom business application, companies can take advantage of a host of benefits that were previously inaccessible. The lower cost of development and reduced barrier to entry empower citizen developers to rapidly build out and adjust customized products to address niche challenges. This ultimately improves company flexibility and agility, enabling deployment of new solutions based on changing markets and business requirements.

Monolithic ERP vendors that cannot break the mould will be left in the dust as demand increases for solutions that enable data-driven decision-making and high usability. Microsoft’s Power Platform is a perfect example of how this trend is already lowering the barrier to entry and discovering untapped value.

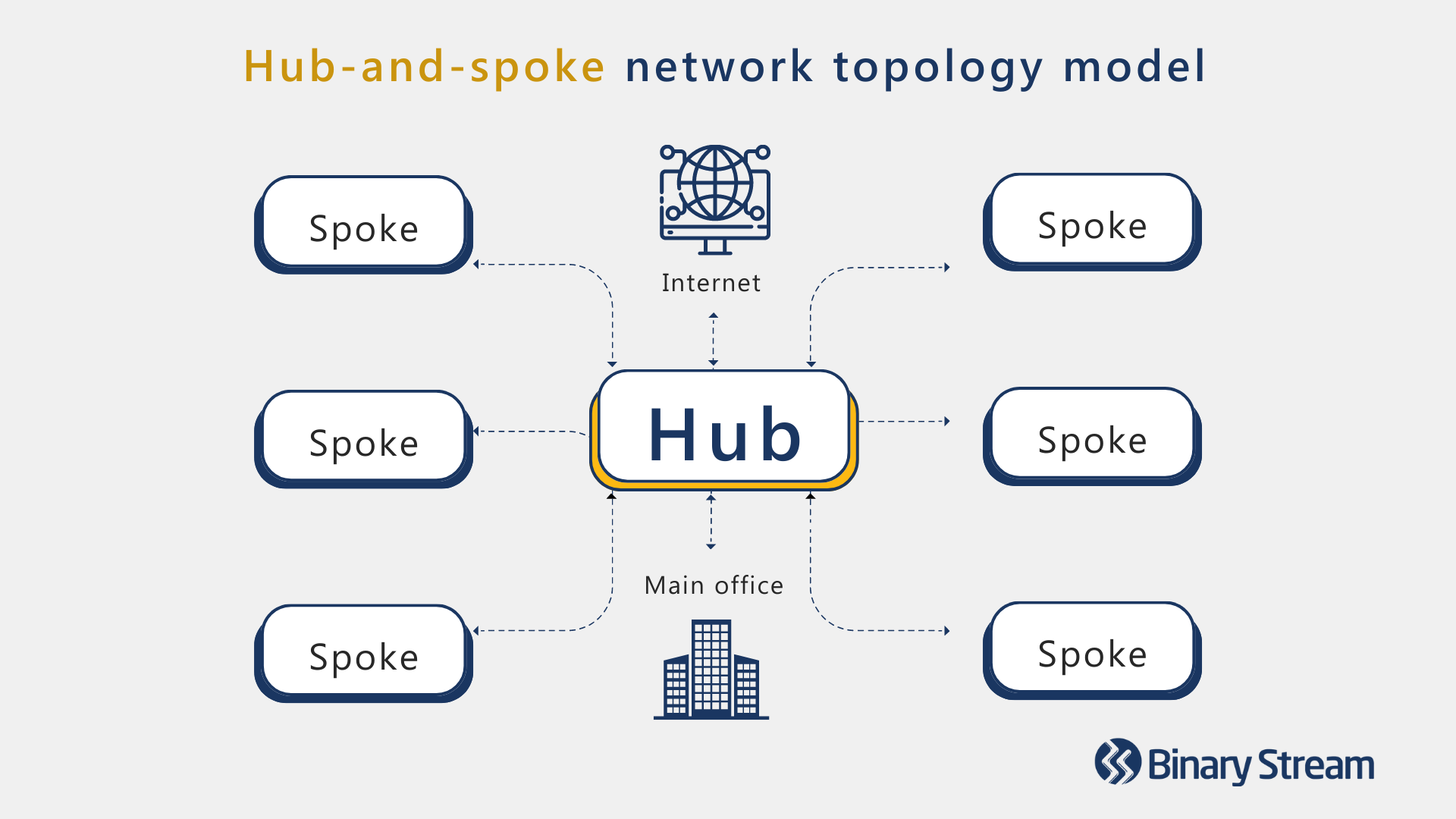

As businesses prioritize cost-savings and agility, ERPs will embrace different architectures that enable companies to quickly adapt to changing markets and, ultimately, do more with less. One of the methods most likely to experience widespread adoption is the “hub-and-spoke” model. Also known two-tier ERP or the star model, it provides a cost-effective way for enterprises to harmonize communication and security requirements across entities of varying sizes and geographies.

It’s particularly useful for those facing the following scenarios:

The ‘hub’ represents the top-tier application used at the corporate level, while the ‘spokes’ represent specialized software managed by the subsidiaries. The hub creates a centralized environment, storing the common service components for spokes to access and enabling the centre of excellence to monitor and control access and usership.

It’s also possible to manage complex multitier workloads by nestling hub-and-spoke architecture within interconnected spokes. Spokes connected to other spokes effectively create a miniature hub. Therefore, a subsidiary can function like a miniature hub with radiating spokes representing different departments or entities.

Further reading: 5 steps to reduce and assess security risk in mergers and acquisitions

Although cloud computing isn’t new, its expanding prevalence is a growing ERP trend. Traditionally, users have been fearful of storing their data in the cloud, citing concerns about cybersecurity and compliance. However, recent advancements have quelled these anxieties and modern ‘Cloud ERPs’ boast many advantages, including:

According to Gartner’s latest forecast, international end-user spending on public cloud services is predicted to increase 20.7% to $591.8 billion in 2023, up from $490.3 billion in 2022. Throughout 2023, more companies will migrate their ERP to the cloud or upgrade their Cloud ERP. One of the ways clouds are maturing further is by becoming verticalized.

Microsoft’s latest cloud initiative offers better security and cloud services segmented by industry. Microsoft’s Industry Clouds cater to challenges inherent to certain verticals like industry-specific regulatory compliance. It’s also likely that companies will move away from using generic solutions in favour of systems that streamline industry-specific requirements.

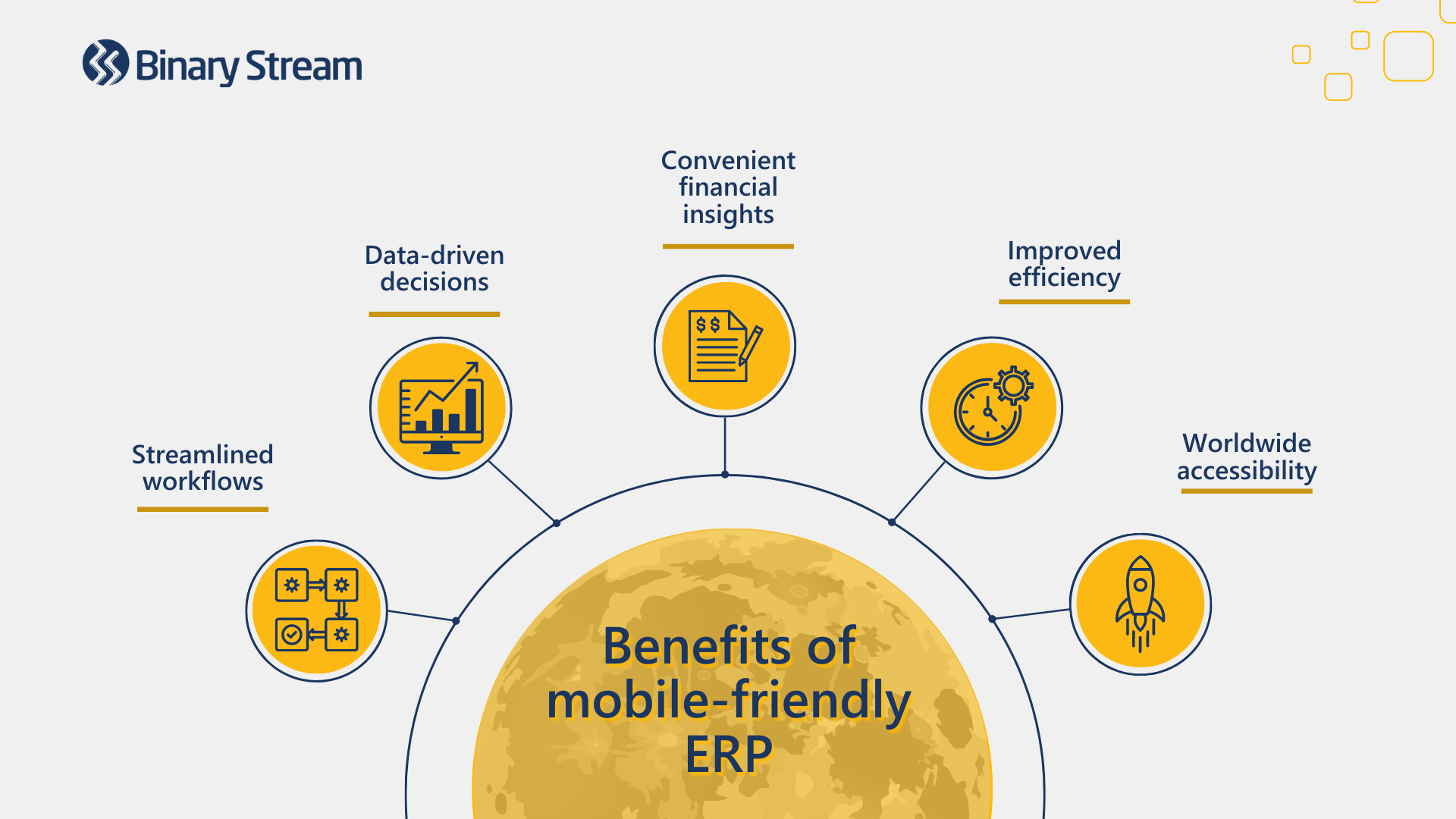

Laptops, phones, tablets—mobile devices have become integral to today’s workforce. Accompanying the rise of remote workers and digital nomads, demand for a mobile app connected to company software is skyrocketing.

A natural extension of cloud-based ERP, mobile-friendly ERP empowers staff at all levels of seniority with real-time access to company information and customer communications. Global Market Estimates predict the global mobile ERP market will grow at a CAGR of 9.2% from 2021–2026.

This ERP trend is already being implemented by Microsoft, who’ve announced that Dynamics 365 Business Central is integrating with Teams. Business Central users can quickly look up contacts, share details, and respond to enquiries within Teams.

In recent years, artificial intelligence (AI) and machine learning (ML) have greatly improved, maturing beyond optional modules to the point where they play key roles in enterprise software. All ERP trends mentioned in this blog are made possible by these innovations.

AI and ML are invaluable tools that augment human productivity through expanded data analytics capabilities, empowering teams to make data-driven decisions faster and with fewer errors. Smart functions like interactive assistants and zero-touch automation allow the software to shoulder the burden of tedious, repetitive tasks.

In 2023, these technologies will continue to evolve, aiding in many departments and industries. For example, AI and ML facilitate digital twins, a digital representation of a real-world product, system, or process. Manufacturers can optimize supply chain management by visualizing their logistics network and tracking shipments using integrations with the Internet of Things (IoT), mitigating global risks and enabling just-in-time delivery.

Further reading: Give your finance function a health check with this simple questionnaire

The booming subscription economy produced a ripple effect that can be felt in virtually every industry and the ERP software market is no exception. Software-as-a-service (SaaS) has expanded in many directions from platform-as-a-service (PaaS) to infrastructure-as-a-service (IaaS) to device-as-a-service (DaaS), etc.

Anything-as-a-service (XaaS) re-envisions business capabilities as a collection of cross-functional, horizontal services liberated from their discreet silos. In the ERP space, this translates to more ERP products purchased over the Internet via subscriptions. This wave of subscription-based business will continue to transform companies, opening the possibility for anything to become finance.

It’s unlikely that end users will replace their ERPs immediately, but many can use modular components and ‘microservices.’ Budget-conscious companies can benefit from lower upfront costs, reduced overhead, no maintenance fees, and ongoing customer support, allowing in-house IT departments to focus on more pressing matters.

Embedded directly in D365 Finance, D365 Business Central, and GP, the following products will take your business processes to the next level:

Poor data management leads to messy, error-prone data and unreliable insights. Finance teams struggling with these issues wind up left in the dark, and businesses lose their advantage over competitors and are more likely to take actions that will hurt the bottom line.

Companies must maintain a high data management standard to ensure that leadership can adequately guide the company in making sound financial decisions and remain compliant with accounting and data protection regulations.

This blog will introduce you to ten best practices in data management for finance teams so that you can harness the power of data analytics.

Interested in a specific aspect of data management? Click on the best practice below to skip ahead.

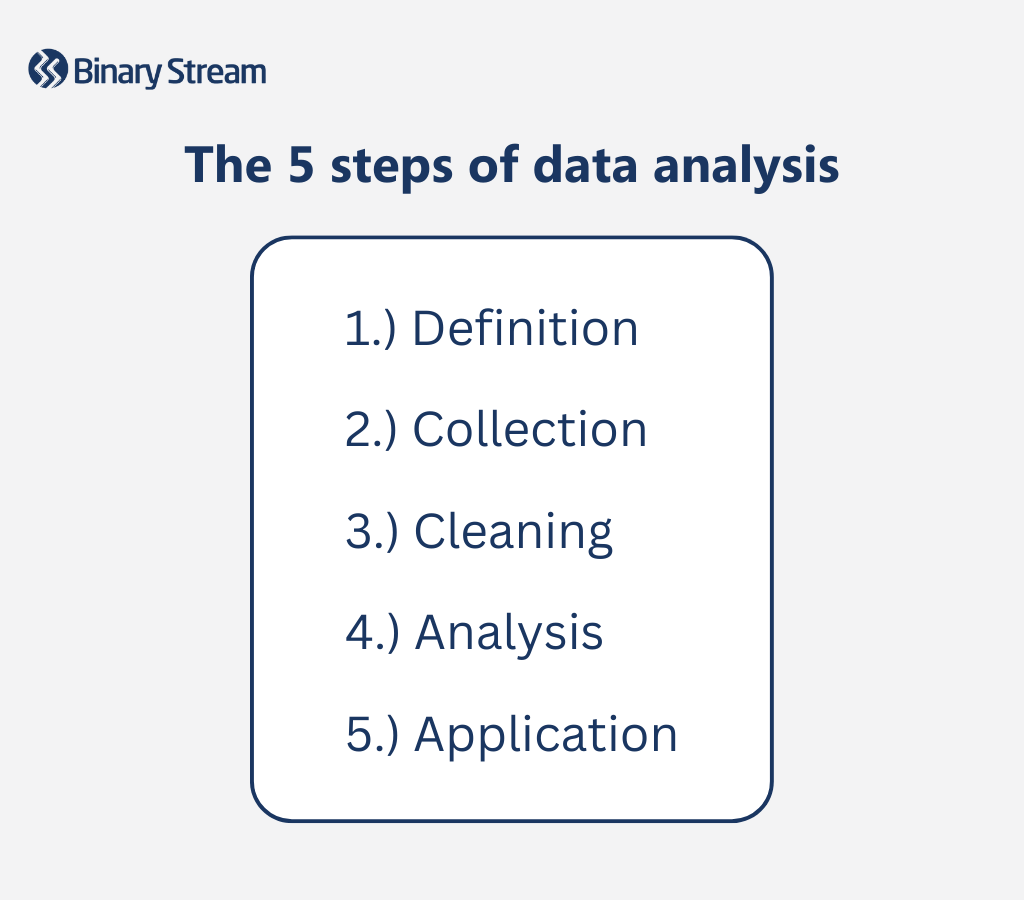

It’s much easier to spot and correct problems early on with a well-structured framework for data management and analysis. To garner better insights, your organization must have clear workflows detailing how to handle data for each of the five steps of data analysis; data definition, collection, cleaning, analysis, and application.

Below are some sample data management workflows covering the five steps of data analysis:

One of the most valuable applications of data is predictive analytics. This information is vital to creating an action plan for proactively responding to threats and opportunities. Companies can build customer behavioural models with today’s technologies and reliably predict future outcomes.

For example, say you want a good idea of when a customer will pay their due invoice. A robust data management system will enable your team to analyze past payment trends, compare them with other customers, and build a forecast model to determine when that customer will most likely pay their balance. By harnessing these insights, you can build reliable customer aging reports and inform dunning policies to maintain positive customer relationships and reduce involuntary churn.

You’ll gain reliable insights from nothing if you try to track everything. While it’s very tempting to maximize your usage of every available feature and collect every fragment of data, you’ll only burn through your resources and become too distracted to find information to answer your initial query.

After all, good data management is about enforcing the seven standards of reliable data:

This best practice is similar to the first step of data analysis, but you apply it to your entire data storage system. First, understand which metrics you want to track. Then, identify your search parameters and the variables that impact those metrics. After completing these steps, you can collect the necessary data to build your model.

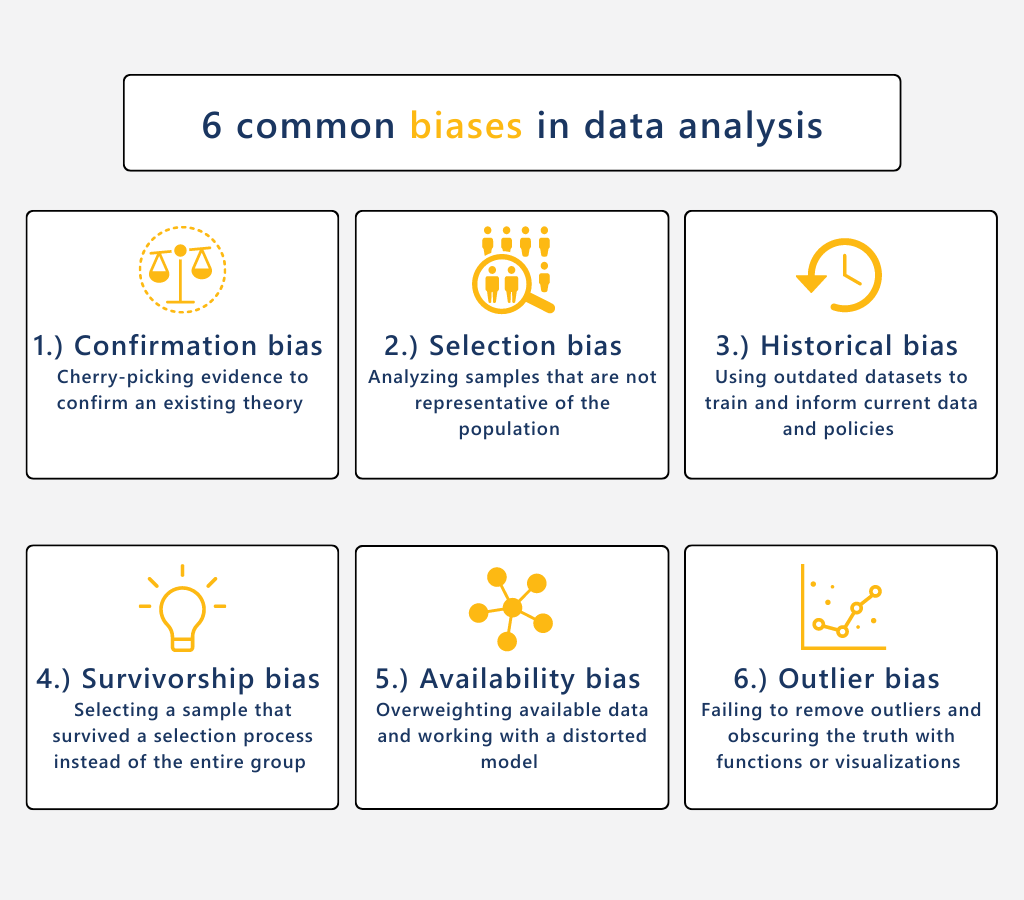

Beware of data biases! Bias is introduced to data when an error causes certain dataset elements to be over-weighted or overrepresented. Common examples of data biases include:

If leadership transitions from intuition-based to data-driven decision-making, they need clean data, or they could make a bad decision that harms the bottom line. Data analysts must note the different biases at each data management and analysis stage. Finance teams can even use AI and machine learning to help check data sets and flag potentially biased data to help raise awareness to leadership.

A common problem with poor data management is that team members lack access to necessary data. Leadership may be unaware that certain information already exists because the data is hiding on their servers and make unwise decisions that could have easily been aided by data analytics.

Of course, that doesn’t mean that everyone at the company should always have access to your company’s financial information. The best course of action is to set up data classification protocols that restrict and grant data access based on projects, job roles, and functions. Another strategy is to implement dashboards that track custom company performance metrics and share them at company-wide meetings.

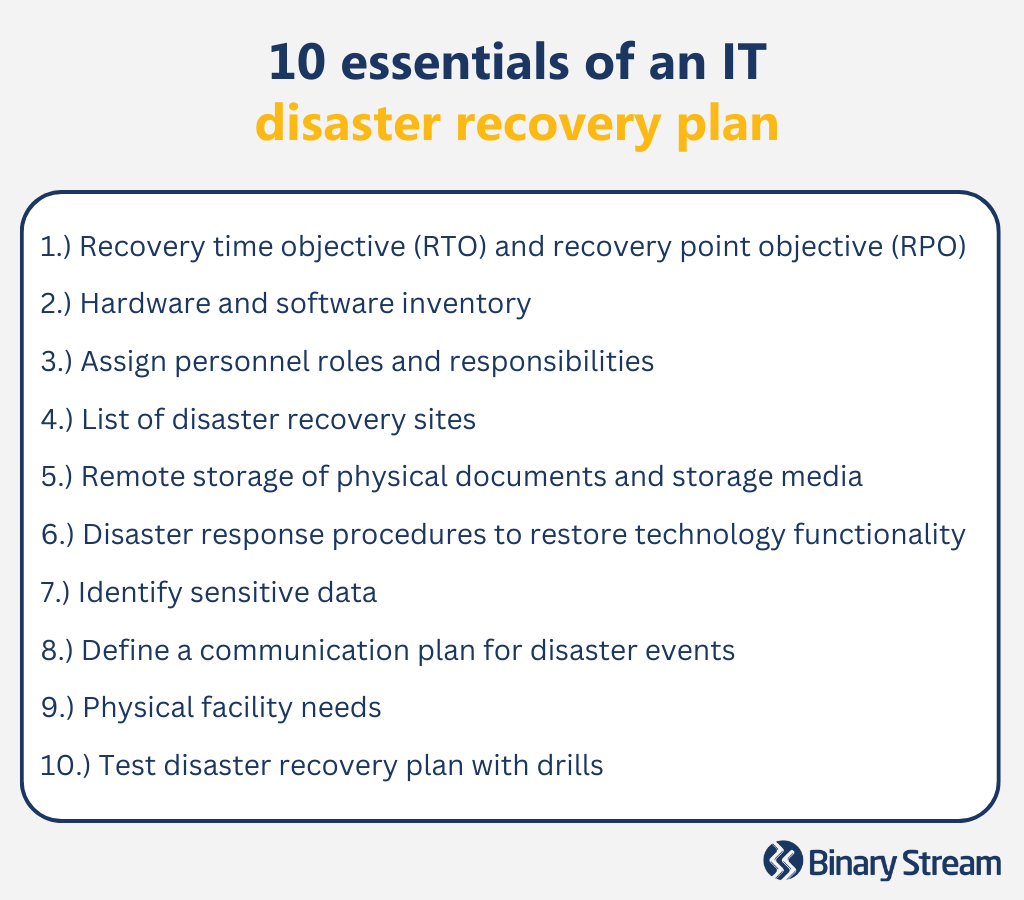

According to Veeam’s 2022 Data Protection Report, the average cost of downtime is $88,000 per hour. While it’s true that number is skewed by larger organizations, that doesn’t mean that it’s cheap inconvenience for small and medium businesses.

Data loss is a distressing, costly event with a plethora of ramifications. Human error, unexpected updates, damage to physical devices like servers, and cybersecurity attacks are all common causes of data breaches and data loss.

The best ways to prevent the more serious impacts of these events are frequently backing up data and having a disaster recovery plan (DRP). A DRP will help to keep business continuity while IT quickly recovers operations, mitigating disruption of product and service delivery.

Protecting your company’s data must be a top priority for all teams. Financial information is confidential, and a breach could result in reputational damage, lost opportunities, and regulatory fines. Strict security protocols are not optional, and any vendors or partners must adhere to the highest data protection standards.

Investing in scalable security tools that support secure sharing and encrypting data flow is essential. Look for SSL encryption, two-factor authentication, advanced firewalls, and automated notifications for new logins. Hosting security awareness training sessions at least once every six months will help your team stay vigilant.

Another great way to protect your data is to build a culture of compliance within your company so finance is always audit-ready. Depending on your industry, you’ll also have to adhere to specific data protection regulations. For example, healthcare organizations must have strong security measures to protect personal information and remain HIPAA compliant.

Check in with your risk and security officers about new technology with autonomous data capabilities that can support compliance. An invaluable data management tool is data discovery, a feature that reviews, identifies, and tracks data chains necessary for multijurisdictional compliance.

However you decide to tackle this issue, no software alone can completely guarantee compliance. Your policies must supplement your technologies to ensure that your team and tools are sustainable and keep pace with rapidly evolving accounting standards.

Spreadsheets quickly lose their appropriateness as the volume and variability of data increase. Real-time reporting and data mining can only truly be achieved with sophisticated business analytics tools and features with AI capabilities.

More importantly, you’ll need a dedicated team of data analysts trained on these latest technologies to enable prompt and accurate insights. Upskilling your existing talent on the finance team will help them become better data managers and result in better forecasting for cash flows, tax liabilities, and revenue growth.

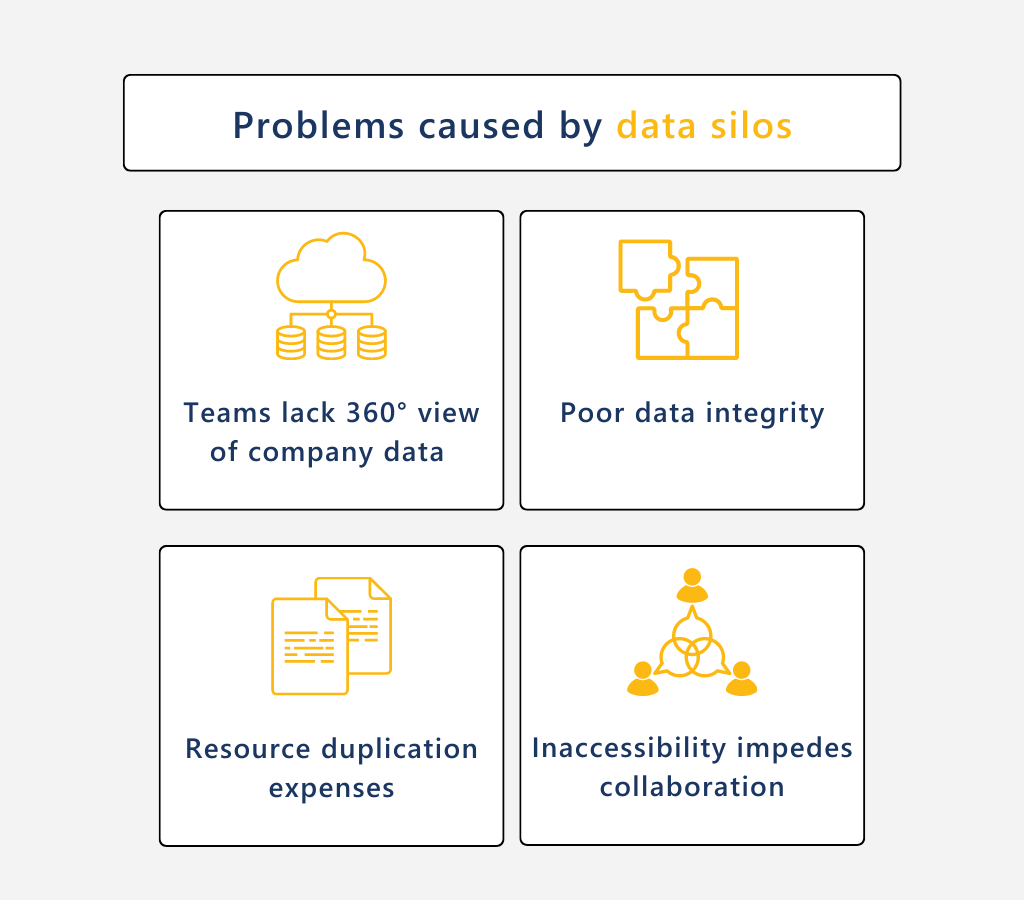

A data silo is an archive controlled by a single entity or is otherwise isolated from the rest of the organization. These repositories crop up in many ways, from files to emails to entire servers, but all share the same trait of hiding potentially vital information.

To gain a full view of your business metrics and understand your financial health at a deep level, your data must be accessible, and your models must include data from different sources. Unstructured, decentralized, and unshared data often cause problems and undermine the rest of the best practices written about in this blog.

If you can only implement one change to your existing data management—abolish the data silos. Whether you need to integrate a legacy system or clean excess raw data, obtaining an accessible and unified data set is worth it.

If you’re looking for more information about data management or have a specific question in mind, feel free to browse the resources listed below or contact our team. We’d love to hear from you.

To succeed in the hospitality industry, companies must continue to exceed customer expectations while simultaneously executing plans for rigorous expansion. However, this is only made more difficult by the host of modern challenges businesses must face. From stressed-out and understaffed teams to budget constraints and poor data management, finance departments are being pushed to the limit where even high performers are struggling to keep up.

That is why many companies are in the process of undergoing a financial transformation. Implementing technology to automate and streamline operations is vital to supporting staff members in delivering quality customer service.

Within the hospitality industry, financial transformation consists of adopting an agile mindset and upgrading to a cloud-based financial management system to streamline workflows, enhance productivity, and impact the bottom line. Often companies will implement a comprehensive enterprise resource planning system (ERP) to optimize operations and centralize crucial information.

By transforming financial management processes companywide, leadership can access strategic forecasting and achieve even the most ambitious expansion plans. Download our whitepaper for an in-depth exploration into how financial transformation can enable long-term, sustainable growth within the hospitality industry, complete with a modern-day case study, checklists, and statistics.

When companies struggle with a pile-up of outstanding invoices, they often suffer from poor cash flow management and strained customer relationships. That’s why accounting departments need to pay close attention to due payments. A key component of maintaining efficient credit policies is a customer aging report. This document provides insight into customer behaviour and supports a phased approach to collecting the total due from your customers while minimizing bad debt. This blog will introduce you to the benefits of a customer aging report and reveal why it’s a good idea to automate it.

A customer aging report, also referred to as an accounts receivable aging report or receivables aging, shows the outstanding balances from customers sorted by time intervals. These time intervals are called aging periods, so the longer a customer owes an overdue amount the more their balance ‘ages’.

The customer aging report is one of the main reports used to reconcile the customer ledger with the general ledger. It aids accounting teams in analyzing the efficacy of credit and collection functions and identifying any hiccups in the collection process. Below outlines four of the benefits of using a customer aging report.

According to a study by U.S. Bank, 82% of all companies fail because of cash flow mismanagement. A large component of maintaining strong financial health is ensuring that your customers pay you on time. Customer aging reports allow you to spot and correct credit risks before your cash flow spirals out of control.

In some cases, the reason why you don’t get paid on time is simply that your customer is on a different pay cycle than what your business offers. Customer aging reports help you to identify issues early, so you can act fast to rectify the situation and retain positive relationships with customers.

Whether that ends up being a quick fix, like realigning your invoice date alerting mechanism, or a longer conversation that involves following up on routine customer behaviours, you’ll have the opportunity to improve your collections strategy and customer service.

Customer aging reports help evaluate the efficacy of your credit policies. If most of your overdue payments result from one customer’s tardiness, you might consider withholding any additional credit. However, when multiple customers are lagging on their payments, it could indicate that it’s time to audit your processes as there may be an underlying issue with your credit policy. Implementing a discount for early payments or charging fees for late payments are two strategies that may be necessary to streamline cash flow.

Further reading: The ultimate ERP requirements checklist and template

A customer aging report is valuable for calculating your doubtful debt allowance (DDA) and average collection period (ACP). Doubtful debts are balances owed by customers where it’s implausible that you will receive the overdue amount, resulting in bad debt.

The DDA is the acceptable value of bad debts to be written off in your company’s financial statements during the period ends. The ACP is the average number of days it takes for accounts receivable to convert to cash and is one of the main parameters used to determine a company’s short-term liquidity.

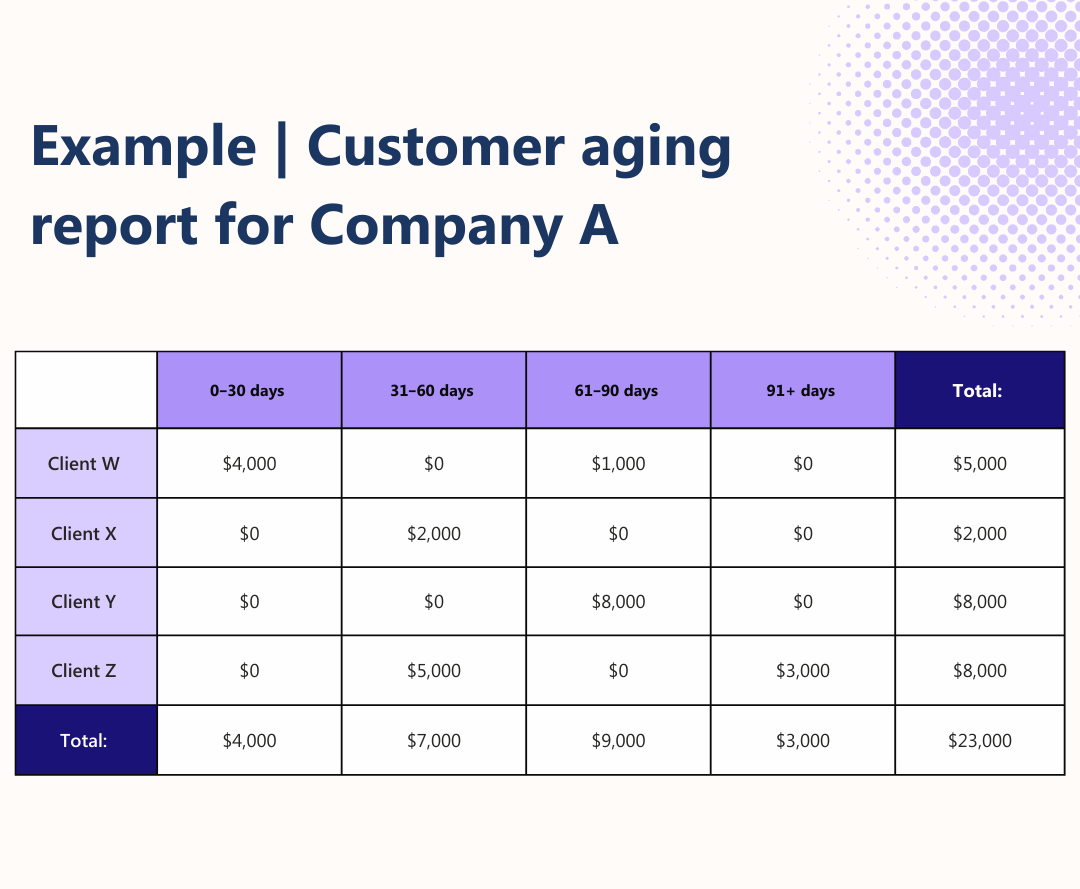

Here is an outline to compile a simplified customer aging report using a spreadsheet:

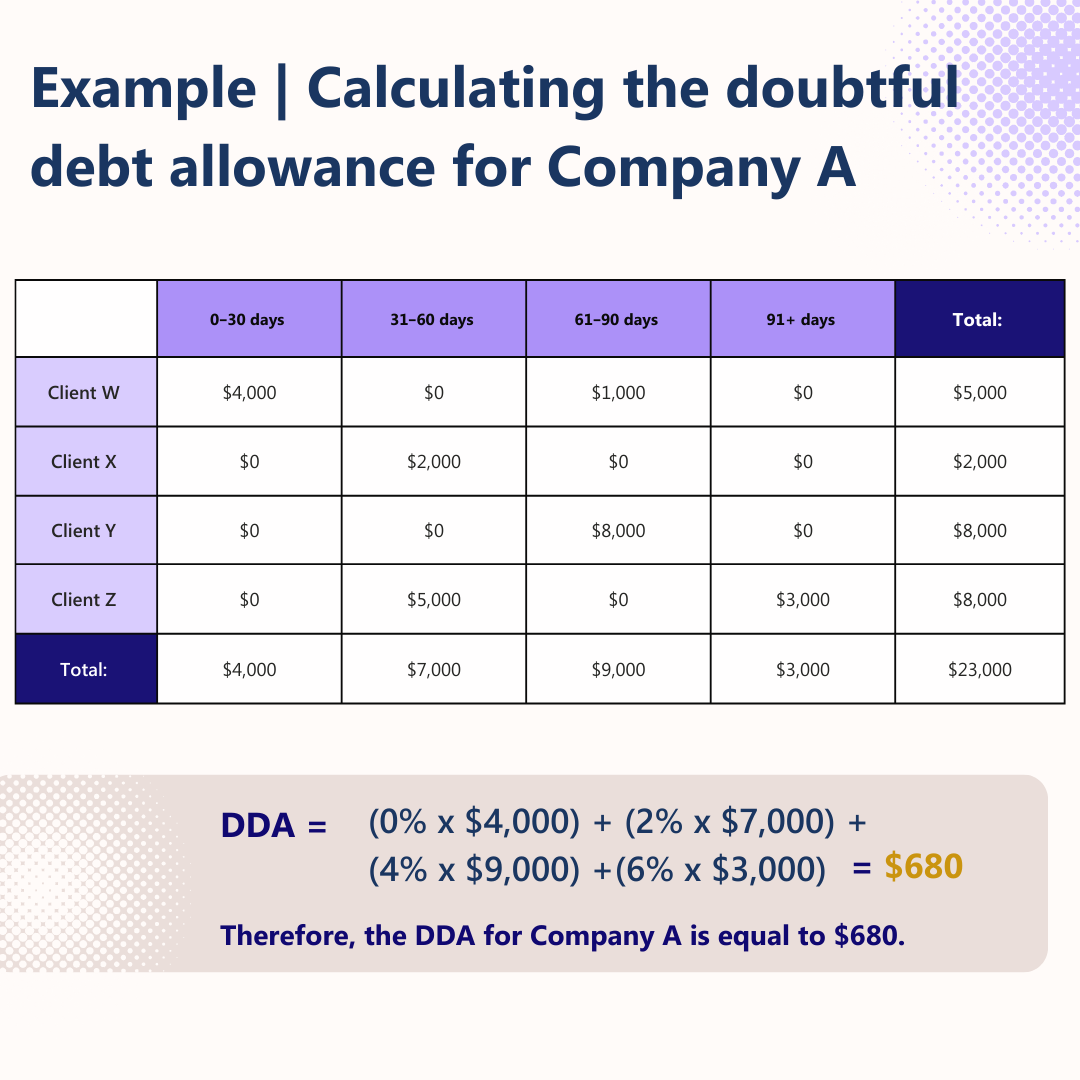

Given that the probability of defaulting increases with the time an invoice has been overdue, leadership can assign incrementally higher fixed default percentages to each aging period. These percentages are often determined by analyzing historical data to see how much was uncollectible during previous aging periods. Applying these percentages to the current value in each aging period and calculating the aggregate returns the expected credit loss, which the accounting department books as the DDA.

Using the example above, Company A reviews its customer aging report to calculate its DDA. They have $4,000 of accounts receivables overdue for less than thirty days. Company A usually has high collectability for this aging period and assumes that none of the accounts will be doubtful.

Based on prior experience, the likelihood of default increases by 2% for every additional thirty days the invoice remains outstanding. Company A applies the following formula to determine its allowance for doubtful accounts:

Therefore, the DDA for Company A is equal to $680.

Calculating the average collection period can help you to evaluate your business’ collectability performance and minimize long overdue receivables. The ACP is the difference between the days sales outstanding (DSO) ratio and the credit period given to your clients.

The DSO ratio provides the average period between when a sale is closed, and the client settles the amount. The DSO ratio can be calculated using the following formula:

If the terms vary greatly between customers, you may need to calculate multiple ACPs for each type of contract.

As your company scales, you’ll require a system that can keep up with your expanding customer database and support best practices in data management. Investing in an ERP solution will allow you to upgrade from spreadsheets. By automating processes like customer aging reports, you can significantly reduce human errors from manual data entry, time spent on redundant tasks, and overhead to achieve a positive impact on your bottom line. If you would like to learn more about how financial transformation can benefit your business, check out our whitepaper.

The hospitality industry is currently undergoing a resurgence as more businesses bounce back from international market disruptions and supply chain issues. The global market value is expected to reach $6715.27 billion in 2026 at a compound annual growth rate (CAGR) of 10.2%. Positive projected growth means that businesses are going to require technology and tools now more than ever before.

Financial management software leverages the latest innovations to streamline accounting processes, allowing companies to smoothly navigate common challenges like cost pressures, staffing, and preventing project overruns. But how do you know which solution will work for your business? Which features are necessary across the board for hoteliers, restaurateurs, and travel agencies?

This blog will walk you through seven features you need to prioritize in your next hospitality financial management software upgrade. However, if you’re looking to take your financial transformation one step further, this blog will provide you with the ultimate guide to choosing an enterprise resource planning (ERP) system.

According to Gartner, by 2024, more than 45% of IT spending will shift to the cloud. This will include financial management and accounting software in many cases, so take advantage of mature software architecture that boasts multitenancy and cloud computing. These advancements allow your company to minimize errors and streamline data management with master records that update in real-time, significantly reducing turnaround during month-end and year-end.

Further reading:

With data at your fingertips, comprehensive reporting transforms numbers into actionable outcomes. AI-based predictive analytics, dashboards, and rolling forecasts enable you to optimize cash flow, improve financial controls, and assess the overall health of your business. When you’re empowered to make data-driven decisions, your company can benefit from improved agility to quickly adapt to an ever-changing landscape.

Tools that support customizable billing options and quick pivots in your pricing strategy are indispensable components of thriving in a rapidly changing industry. Some leading companies are turning to subscription billing options to overcome massive disruptions. If your business is also considering introducing a subscription service, you’ll likely need to experiment with different pricing models and billing frequencies before finding the right fit.

Further reading: Whitepaper | The CFO’s playbook for SaaS transformation

Manually tending to inventory management can waste valuable time and resources, and full visibility is necessary to overcome global supply disruptions. The right software will facilitate process automation, yielding rapid improvements to order fulfilment, receipt of goods, serial and lot value inputting, batch document delivery, and document consolidation processes.

There’s a lot of administrative work involved with managing property, plant, and equipment leases. If you rely on paper-based systems, it will be impossible to scale appropriately. Lease management software can mitigate the risk of several common pitfalls. Digitalizing your lease portfolio prevents lost documentation and helps you keep track of critical dates, so that you never make a late or inaccurate payment.

Businesses in the hospitality industry often handle sensitive data, sometimes across multiple entities. Therefore, a robust security setup is a non-negotiable feature of your system. Look for software that offers SSL encryption, advanced firewalls, two-factor authentication, and automated notifications for new sign-ins. It’s especially critical that multi-entity companies have a clear organizational structure and can centrally manage security role-based access levels.

Too often, companies will invent complicated workarounds to try to compensate for a system that can’t keep up with the latest accounting standards. When the average cost of non-compliance is around $15 million, three times higher than compliance, the risk is not worth it. Making it a priority to invest in hospitality financial management software that enables hospitality-specific regulatory compliance can save your accounting department from a financial nightmare and your company from hefty penalties.

Further reading:

Most hospitality companies are fraught with the challenges of effective financial management in a world where disruption is the new normal. Smooth accounting operations are essential for sustainable growth and scalability in this industry. Those that fail to adopt best practices and tackle the issues with lean, agile solutions are likely to be buried by tedious manual processes and an inability to make strategic moves in a fast-paced, constantly changing world.

Making decisions based on gut feelings is no longer viable. With data becoming increasingly crucial for stakeholders and investors, investments now depend on access to accurate forecasting and reports. Risk management is another motivator for those revamping financial systems. No accounting team wants to stifle the growth of their company, yet, modern compliance standards are increasingly demanding, and there’s a degree of transparency required by regulators that is impossible to maintain with outdated solutions.

Many finance teams are weighed down by manual processes, struggling to consolidate multiple entities, keep up to date with leasing requirements, and spend most administrative time on balance sheets and reporting. Often this work involves a degree of correction that should not be necessary when technology can automate many of the workflows that lead to the most common errors on financial statements and reports. Keeping up administrative workloads often leaves little time for teams to adapt to the subscription economy or implement innovative, competitive strategies.

This blog covers the everyday financial management challenges hospitality faces, with simple solutions suggested for each one. Before you jump in, give your finance function a health check with this simple questionnaire.

Given the sheer amount of financial data flowing through the average hospitality company, it’s no surprise that one of the biggest concerns accounting teams faces is keeping data clean and free of error while maintaining the security of sensitive information. The bigger a franchise or organization, the more complex things can get, with companies needing to adopt systems that can handle the workload of increased intercompany transactions without causing severe bottlenecks.

With data now at the heart of strategic decision-making, the need for effective data management is a critical component of healthy growth. It’s not uncommon for audits or data breaches to slow down productivity for weeks, if not months, a risk most cannot afford to take. Hospitality companies can overcome this financial challenge by introducing several measures to maintain secure, reliable data across all entities and departments.

Effective financial management in the hospitality industry often requires accounting teams to produce consolidated financial statements that allow leadership to get an overview of overall performance across the entire enterprise. Of course, this ties into the challenge of maintaining reliable and secure data, but it’s a separate concern with its nuances.

Parent company accounting teams often face significant roadblocks when it comes to consolidating financial information. They may not have access to data from all entities, and other groups may forward reports in inappropriate ways (email, excel files, etc.). Not only does this make it challenging to obtain the necessary data, but it can introduce issues of fraud and data manipulation when the parent companies do not have a clear view of financial processes across all entities.

It’s possible to solve this issue by investing in a centralized accounting system specializing in consolidated financial statements. Building a robust financial backbone is essential to sustainable progress when it comes to solving the financial management challenges hospitality faces.

Expectations around data governance and global compliance have never been higher. Most hospitality franchises will be subject to different rules and regulations that govern their accounting practices. Staying on top of fluctuating regulations can strain even the highest performing teams, especially when accounting teams need to maintain compliance for everything from recurring revenue and financial consolidation of multiple entities to lease accounting standards.

It can be a headache, so it’s often best to nominate team members to stay on top of requirements, brief the team on any changes and rewrite data management policies to reflect these when necessary. It’s also wise to invest in a solution built to handle the complexities of modern compliance, so your team can avoid the risk of hefty fines.

The struggle to achieve financial transformation is not unique to the hospitality industry. Across the world, companies face the challenge of introducing agile workflows and replacing legacy, on-premise systems with more comprehensive financial management systems. Add to this the rate of failure of the average transformation, and it’s no wonder that accounting teams can be reluctant to undergo the upheaval.

Many issues arise because finance manages the entire transformation in a silo, without any effort made to spread the workload across the whole organization. It’s a process that touches on and involves every corner of operations and will require a company-wide effort. The solutions below include a collection of resources to help you navigate the major shifts and challenges of financial transformation.