Fractional ownership is having a moment, and it’s no wonder why. With inflation escalating the cost of many high-value assets globally, investors are looking for more cost-effective ways to gain ownership. With fractional ownership, investors pool resources and collectively own assets. It’s a strategic way for many to lower the barriers to entry and reduce the cost of investing in shares of a company or buying assets.

What is fractional ownership?

Fractional ownership is an investment where the cost of assets is split between shareholders. At its most straightforward, it is the percentage ownership of an asset. Owners or shareholders share the costs and benefits. Access may differ for various parties depending on the percentage ownership, but the benefits usually include usage rights, priority access, reduced rates, and income sharing. Suitable assets are generally capital-intensive, with the need for only occasional usage.

What is fractional ownership in business?

Fractional ownership in business is an investment where the asset/property is split between shareholders. It adheres to the same principles as regular fractional ownership. However, it’s often on a far grander scale. It allows companies and corporations to acquire assets that would be otherwise unaffordable.

The strategy is most effective where companies want to diversify their portfolio without taking on too much risk. It can also allow for the purchase of property or assets which are more stable than the stock market, giving companies access to stabilized income (e.g. fixed rents) while conservatively investing their funds.

What are the benefits of fractional ownership for business?

If you don’t have fractional ownership experience, you might wonder about the benefits. Below are the five core benefits that make this investment type critical for companies as they expand.

1. Simplifies investing, saving time and expediting the decision process

Investments tend to involve a lot of time and paperwork, with teams struggling to complete these processes efficiently. Experts claim that the administrative burden is often lighter with fractional ownership as agreements and documentation tend to exist already, allowing companies to review the terms and make decisions quickly, benefitting companies who are in a hurry to invest.

2. Cost-effective investment with high yields at low costs

One of the leading benefits of fractional ownership is the cost-effective nature of the investment. Companies gain access to all ownership advantages without paying or borrowing large sums of money at the outset. Where there is rental revenue or stock appreciation, investors reap the rewards without paying the total ownership costs.

3. Predictable earnings provide a consistent income

Often the kinds of commercial real estate available for fractional ownership are called Grade A properties. Grade A properties tend to be home to multinational corporation tenants. Given the value of these properties and the coveted locations, the lessees are locked in with extensive terms defining future rent escalations. Those entering the fractional ownership agreement can easily see expected income streams and accurately predict the return on their investment.

4. Diversification of portfolio across a variety of assets

Fractional ownership gives companies the flexibility to invest in several markets, properties, or assets. Rather than putting all their eggs in one basket, they can spread funds across several key growth areas and monitor returns. This allows companies to grow and diversify their portfolios simultaneously and gives them the flexibility to make responsive decisions in times of uncertainty.

5. Lowers risk and instability in uncertain markets

Fractional ownership outperforms other investment types in three core areas: safety, stability and return on investment. The presence of an asset with consistent, predictable returns makes these types of investments particularly beneficial in times of economic uncertainty and fluctuating markets. Another reason they’re solid investments is the ability to quickly sell stocks or portions of the assets in times of flux.

How do companies distribute usage rights with fractional ownership?

There are two ways that companies tend to distribute rights for fractional ownership of assets. These are the pay-to-use, and the usage assignment approaches.

Pay-to-use

In this approach, co-owners pay a fee to use the property or asset. Generally, usage is calculated over a set period, i.e. per diem/week. Usage fees and rental income cover the costs of the asset. Any surplus is split between co-owners. When a deficiency arises, co-owners split the cost of satisfying the difference. Usually, the percentage of ownership does not impact usage rights, as all owners can pay to use the asset, and the amount paid in these instances is based on the usage amount.

Usage assignment

All co-owners have a set number of days to use the property or asset in a year. Duration of usage can be either fixed or flexible or a mixture of both. Co-owners can use the property/asset during their assigned usage periods. In this type of agreement, co-owners’ usage rights and the amount paid for ownership should be proportional to each other, i.e. those who invest less have less access to usage or a lower number of assigned days.

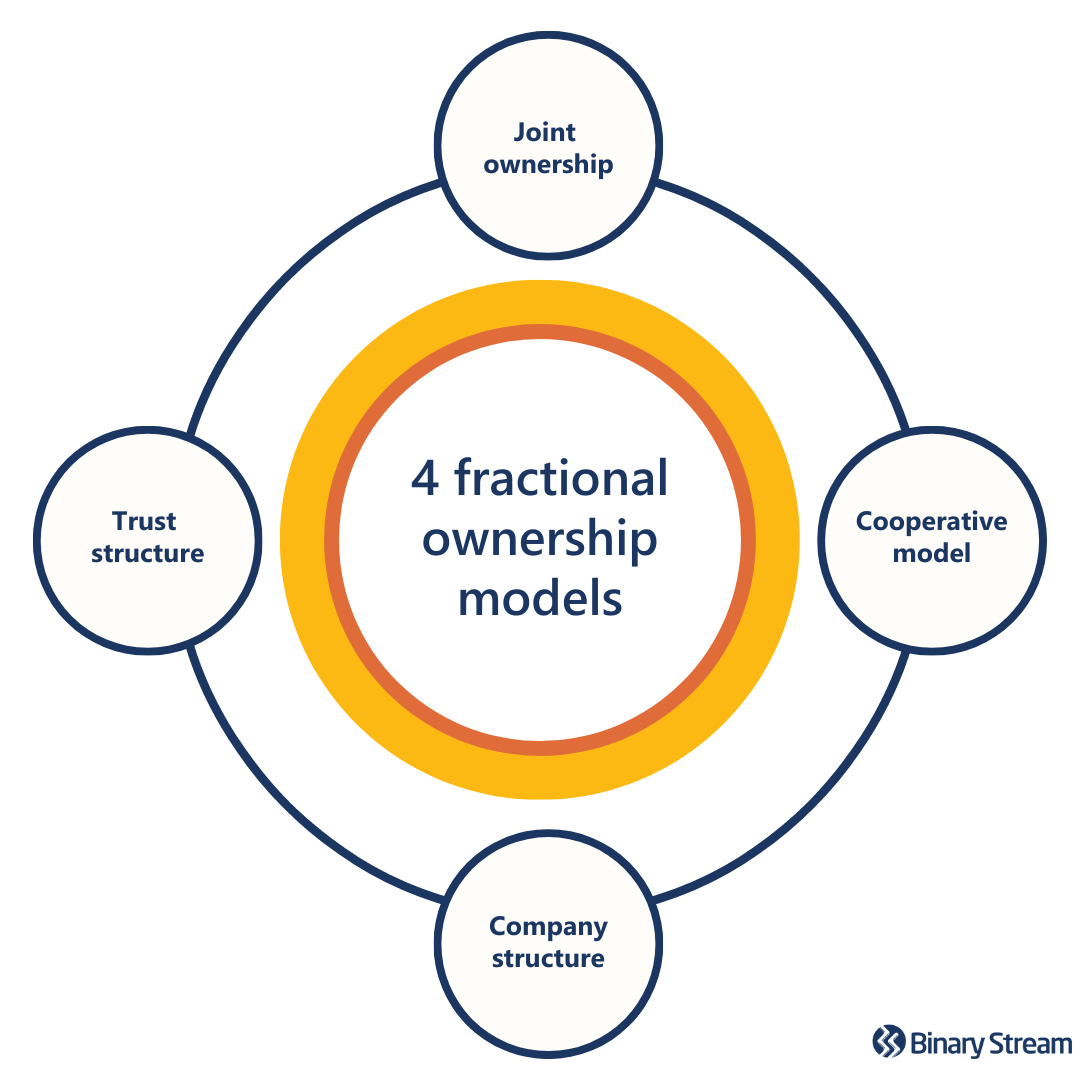

What are the most popular fractional ownership models?

Fractional ownership varies from agreement to agreement, but there are a few core models that can easily be identified. Below we outline the most common models, however, please not that it’s essential to have these agreements reviewed by legal experts who can make sure everything is in order before you invest.

Joint ownership

In a joint-ownership agreement, all the asset owners are co-owners. It includes a wide range of ownership types, including various types of tenancy. Where ownership is split into equal portions, it is referred to as joint tenancy. There are several different ways this model is applied. Those investing in joint ownership should pay particular attention to unity of title, unity of interest, unity of time, and unity of possession.

Company structure

In a joint-ownership agreement, all the asset owners are co-owners. It includes a wide range of ownership types, including various types of tenancy. Where ownership is split into equal portions, it is referred to as joint tenancy. There are several different ways this model is applied. Those investing in joint ownership should pay particular attention to unity of title, unity of interest, unity of time, and unity of possession.

Cooperative model

This model requires investors/key stakeholders to form a cooperative society which purchases an asset together, with each party owning a piece of the property/asset. They then share income, employment, and services, while investing time, labour, products, and other resources into building the value of the asset/property. This is less common among businesses but can be effective for community-based enterprises. Stakeholders in the cooperative are free to sell their shares and responsibilities to new owners.

Trust structure

The party responsible for selling the asset/property executes a trust deed which potential fractional owners create. This structure is subject to precise guidelines that must be adhered to, mainly where offshore trusts and tax treaties are involved. Companies that want to reap the tax benefits of this kind of model should speak to a team of trusted advisors before investing.